Technology

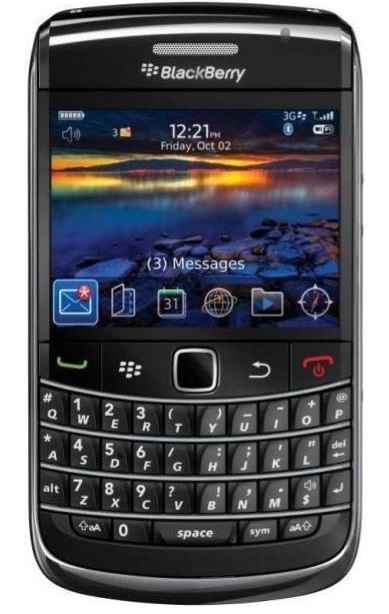

BlackBerry strikes preliminary go-private deal for $4.7 billion

BlackBerry Ltd. said on Monday it reached a preliminary deal with one of its biggest shareholders to take the company private for about $4.7 billion, as it harbors hope that a better offer might emerge.

BlackBerry Ltd. said on Monday it reached a preliminary deal with one of its biggest shareholders to take the company private for about $4.7 billion, as it harbors hope that a better offer might emerge.

Fairfax Financial Holdings Ltd., a Canadian insurance firm, signed a letter of intent with the BlackBerry board under which it could pay $9 a share in cash for the 90% of BlackBerry shares it doesn't already own.

The hastily arranged deal came over the weekend, according to people familiar with the effort, after BlackBerry announced on Friday it had nearly $1 billion in unsold phones and would slash 40% of its workforce. The stock plunged 17% that day to below $9.

But the deal is far from complete. It is subject to six weeks of due diligence, and BlackBerry can shop the company during that period. Fairfax would still have to arrange financing.

The agreement also doesn't compel Fairfax to ultimately come forward with a firm offer, underscoring the weak negotiating position BlackBerry finds itself in. BlackBerry, on the other hand, would have to pay a breakup fee of more than $150 million if it turns to another buyer by Nov. 4.

BlackBerry's unusual move to put together a loosely structured deal was motivated by its rapidly deteriorating business, several people close to the situation said. By publicizing a deal with a starting price, the company's hope is that will lure rival offers for part or all of BlackBerry, one of the people said. This person characterized the proposed deal with Fairfax as a "backstop" in case nothing better comes along.

Fairfax had some of the same interests. "We thought, every day that goes by, if the position of the company wasn't stabilized they would lose employees and customers, and we thought it was appropriate to do the deal [now]," said Fairfax Chairman and Chief Executive Prem Watsa in an interview.

BlackBerry chairwoman Barbara Stymiest said in a statement that the special board committee formed to evaluate options is seeking the best deal and will listen to alternatives to Fairfax's proposal.

BlackBerry's stock recovered slightly on Monday, rising 1.1% to $8.82.

A number of private-equity firms in the U.S. and Canada, and possibly tech companies in Asia, have considered bids for at least part of the ailing Canadian company, people familiar with the matter have said. But it isn't clear if they are currently interested. BlackBerry formed the strategic committee to search for a buyer about six weeks ago.

Even if a deal does go through, BlackBerry's future remains unclear. The company said Friday it would stop selling its phones to consumers after weak demand, and few analysts ascribe any value to BlackBerry's namesake smartphone business.

There are a number of assets that could be attractive to a potential buyer. BlackBerry's cash pile, while falling, sits at about $2.6 billion, while its patent portfolio is generally valued at more than $1 billion. The company also still has a widely respected security network on which phone data is transmitted, also said by analysts to be worth more than $1 billion.

"I know most people don't think so, but we think over time [BlackBerry] can be successful again," Mr. Watsa said in an interview. "We think in a private setting this company can do well, without all the noise from the marketplace."

Mr. Watsa, who stepped down from the board last month to avoid potential conflicts of interest, said the company's recently announced plan to refocus on business customers "is the right way to go." But he said the investor group hasn't decided whether or not the company's current management team will stay in place or whether BlackBerry will continue to make phones. "It's early days," Mr. Watsa said.

Mr. Watsa acknowledged the company's latest poor quarterly results and said they would be examined carefully. "There have been some significant write-offs recently so we've got to understand that" before a deal is completed.

And he conceded that the pace at which BlackBerry was losing customers and market share—and burning cash—was a factor in the deal's timing.

Canadian pension funds will likely be involved in the deal, Mr. Watsa said, without providing specifics.

BlackBerry didn't say who, apart from Fairfax, would take part in the consortium, but according to people familiar with the matter, Canada Pension Plan Investment Board and Ontario Teachers' Pension Plan could take part.

Spokeswomen for CPPIB and the Ontario Teachers' declined to comment.

BlackBerry co-founder and former co-chief executive Mike Lazaridis is considering a separate offer, people familiar with the matter said. Mr. Lazaridis has also discussed a joint bid with Mr. Watsa, two people said.

Mr. Lazaridis's interest in the company is serious, and he could still make a competing bid, a person familiar with the matter said Monday. Mr. Lazaridis already owns a stake in the company, which amounted to 5.7% earlier this year, and this person said he has more firepower at his disposal.

Mr. Lazaridis, through a representative, declined to comment.

BlackBerry's decision to sell to Mr. Watsa's group was led in part by a group of three new BlackBerry board members and the special committee. A deal will likely be seen as a concession that a plan put in place by Chief Executive Thorsten Heins to sell a new line of phones has fallen flat.

BlackBerry said the consortium will seek financing from Bank of America Merrill Lynch and BMO Capital Markets. J.P. Morgan Chase & Co. and Perella Weinberg Partners are acting as financial advisers and Skadden, Arps, Slate, Meagher & Flom LLP and Torys LLP are acting as legal advisers.

(Published by WSJ - September 23, 2013)